Playful

Growth

We collaborated with a leading financial risk advisory to scale its business and applied an approach of gamification to turn its customers into enthusiastic users.

Companies in the digital economy often stand out by a special quality: their ability to provide a service that is at the same time highly personalised but also scalable at will. Thereby these companies serve large numbers of customers, while individually catering to personal needs of each of them.

One sector facing the challenge of establishing a service with such a tricky combination is the financial risk advisory business. Its companies continuously assess assets and cash flows of their clients to identify, quantify and hedge different risks.

In that context we received an enquiry from one of Europe's leading financial risk advisories. It provides services such as developing hedging strategies based on derivatives to protect its customers from price fluctuations like rising or falling exchange rates. At the time, the advisors used Excel spreadsheets that had to be manually filled in, updated and analysed. Furthermore, its ongoing services such as monitoring, reporting and adjusting of hedging strategies required extensive manual efforts.

Our client aspired to bring an even more personally tailored service to a larger group of customers. We co-created a concept for the development of an analytics platform as common workbench for advisors and customers. One key characteristic of this platform was a high degree of automation that would allow the future scaling of our client’s business.

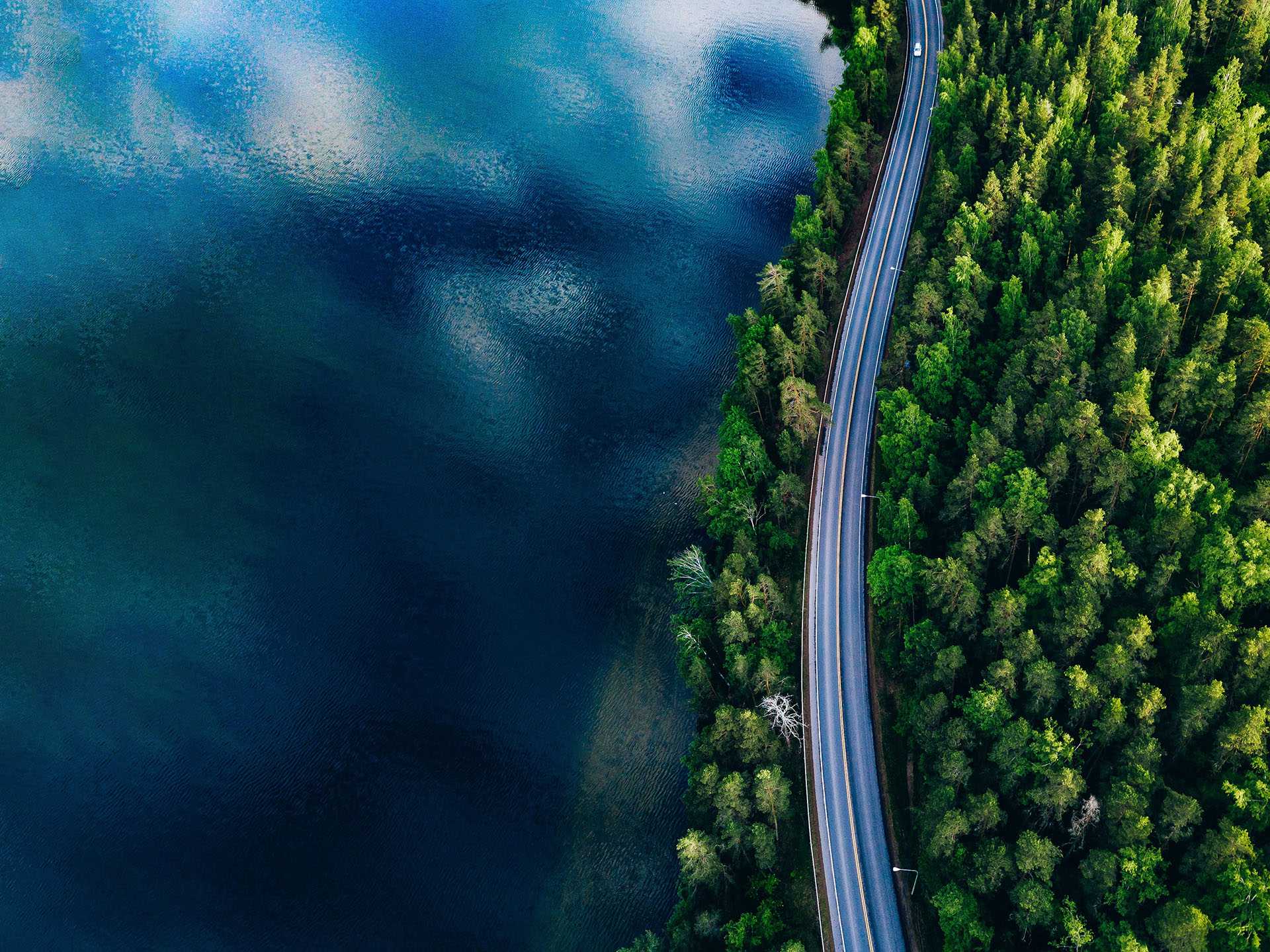

Cooperation across borders

Hence, we created an interdisciplinary five-member team including a business analyst, data analyst, IT architect, UX designer and a change manager. Our experts worked both at the client's headquarter in London and in our offices in Munich and Wrocław.

Besides the necessary technical understanding of derivatives and IT, the project required a sensitive change management perspective. Therefore, we first strove to gain a deep understanding of our client’s structure and work environment. Then we strengthened cross-functional links between all units including product development, financial engineering, IT and sales. That intensified cooperation among our client’s units facilitating the standardisation and automation of processes.

“By joining forces and knowledge with our client's experts we automated regular chores to create more space for creative tasks in serving customers. This is how we put individuals and their business needs at the centre of attention.”

Rupert Hughes, Lead Expert Quant IT for Finance

The platform that we developed is a preconfigured environment that allows modelling, valuation, reporting and automation of workflows like market data cleansing. As a result, the hedge advisory could focus on its core skills and swiftly extend its service to new customers. That made its business highly scalable.

Getting up to Speed

before the project

after the project

Set up hedging strategy for a new client:

2 dys

< 4 hrs

Adjust a client’s hedging strategy:

1 day

3 mins

before the project

after the project

The hedge advisory’s customers benefited from several further improvements: Onboarding had become easier and faster; model calculations could now be processed immediately; and analysts had more time for their primary task of refining algorithms leading to bespoke hedging strategies.

Power to the People

Efficiency boost to risk advisors:

400%

Finally, we also improved the user friendliness. Namely, we developed a dashboard enabling clients to get a good overview of all relevant data and financial products, and to playfully run through different economic scenarios. This approach towards gamification not only provided a clear picture of different options, but turned the otherwise somewhat dry hedging process into a fun exercise.

Thanks to all these improvements the hedge advisory recently received a widely coveted industry award as Risk Management Advisory Firm of the Year. Today, it forms an integral part of a globally leading financial risk advisor.

How to Get in Touch

Do reach out to our regional experts who will be glad to assist you or put you in touch with our specialists.

Related Content

Knowhow - Quant IT for Finance

Easing Navigation

in a Complex World

Explore our work in Quant IT for Finance ›